- Institute Home

- Research

- Reports

- TANF

- Medical Debt

- The Link Between Employment and Well-Being

- Billed to the Breaking Point

- Live a Day (Workforce to Disability)

- Financial Drain (Payday Lending)

- Overlooked and Undercounted

- The Status of Working Families

- Clearing the Jobs Pathway (Adult Learners)

- Wages, Wealth and Poverty

- Paid Family & Medical Leave

- Policy Briefs

- Fact Sheets

- Presentations

- Community Needs Assessments

- Listening to Hoosiers

- Reports

- Policy Advocacy

- Blog

- Take Action

- Who We Are

- Media

- Donate

- INCAA Home

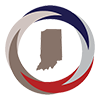

Fair Tax CodeWhen it comes to taxes, Hoosiers want to see that each person and business is contributing their fair share to the services and supports we need to have quality of life and quality of place. A fair tax code means:

Featured Publications

Other Publications

Presentations

|